Wondering why financial advisors in Singapore choose this profession despite the stigma? Surprisingly, they’re not in it just for the cash.

Picture this: you receive a message from a friend you haven’t heard from in years. You’re thrilled to reconnect… until you realise they’ve just embarked on a career in financial advisory. You wonder if they’re really reaching out to catch up, or if they’re looking for a sales opportunity. If this sounds familiar, it’s because many of us have experienced this with financial advisors (FAs) in Singapore. Just take a look at this recent post by local social media and news site SGAG:

But is it fair to paint all FAs with the same brush? Are they really all just out for our money, or is there more to the story? We sit down with some local financial advisors to get the inside scoop.

Financial advisors in Singapore: Not everyone is a bad apple

Financial advisors aren’t strangers to the fact that they have a less-than-stellar reputation. They know we think of them as pushy salespeople who resort to shady tactics to get their hands on our hard-earned cash. Some even joke we should be just as wary of financial advisors on dating apps as we are of catfishers.

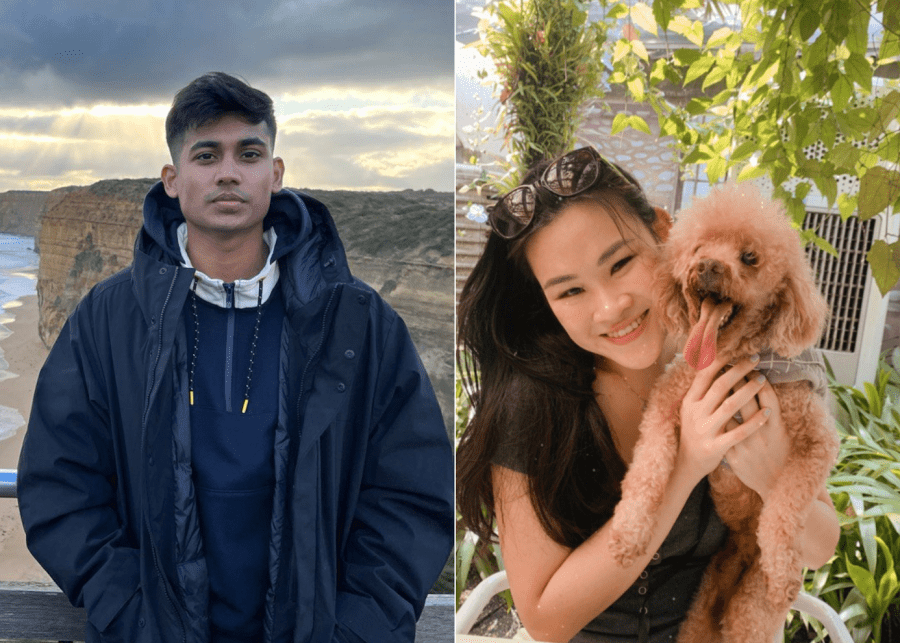

Jarrod Wong, a senior wealth management consultant at TallRock Capital, acknowledges that there’s a genuine stigma associated with the role. When he began his career as an undergraduate, he received numerous comments such as, “Are you here to sell me something and vanish?” or “Are you suggesting the most expensive product to earn money from me?”. Even family members of clients have questioned his age and trustworthiness. However, he strongly maintains that these misconceptions are simply part of the job; anyone passionate about this field of work will encounter them.

Similarly, Tiffany Ow, associate director of sales at Manulife Financial Advisers, also faced initial shunning at the start of her career. She recalls, “I’d get ‘blue-ticked’ by friends who chose to distance themselves from me after I joined the industry. At street canvassing or roadshows, people would directly reject me.” Yet she doesn’t blame Singaporeans for their negative perception of FAs. She explains that financial advisory has earned a bad name thanks to dishonourable individuals who abuse their clients’ trust.

“[These misconceptions] are true for some individuals who join this profession thinking it’s an easy way to earn money,” says Sumit Tiwari, a certified affluent wealth manager and estate planner. Even he has been approached by “experienced” advisors who clearly didn’t have his best interests at heart.

This behaviour is particularly common among new financial advisors in Singapore who feel pressured to meet their targets. Or even experienced advisors who take on too much debt to finance their extravagant lifestyles. “When they stop working and loan payments are due, they may resort to questionable tactics to acquire new clients or take advantage of existing ones,” Jarrod explains.

But as Sumit points out, every profession has its bad apples. The key is to find the ones who are truly passionate about helping clients achieve their financial goals.

Weeding out the black sheep

So, how can you suss out shady financial advisors in Singapore? According to the trio, the biggest red flag is if you feel pressured to sign a policy during the very first meeting. “Consider this: the advisor probably doesn’t know your financial background, your goals, and what you’re aiming for. It’s suspicious that they can come up with a recommendation so quickly,” Jarrod says.

For Tiffany, the best way to identify untrustworthy advisors is to decline their first proposal and tell them you’ll think about it. “Observe their reaction to your response,” she explains. “It can reveal a lot about their intentions. If they’re just focused on making a sale, they’ll try to force the decision. However, if they genuinely care about your best interests, they’ll prioritise learning more about your thought process.”

Sumit points out other warning signs such as only being presented with the advantages of a product and not its disadvantages; or receiving a pricey quotation without any justification or explanation.

Jarrod suggests meeting with an advisor at least three times to ensure they understand your needs and goals. This can also give you ample time to consider the recommendations. “During the first meeting, I get to know the client’s needs, and they learn about the services I provide. In the second meeting, I present my recommendations. Finally, the last meeting is for administrative paperwork. Each advisor has their own approach, but this is how I prefer to operate.”

Chasing purpose in a misunderstood profession

After all that’s said, it’s still easy to assume that the allure of money outweighs the potential damage to the reputation of financial advisors in Singapore. But after chatting with Jarrod, Tiffany, and Sumit, I discover a common thread that runs through them: a genuine desire to make a positive impact in their clients’ lives. This is what drives them to excel in their role.

Tiffany’s journey began after graduating from university in 2018. “I wanted a career where I could be in control of my future while contributing to society,” she says. “The immense value [financial advisors] bring to people was something I strongly believed in, and could see myself doing for a lifetime.”

As an opportunistic undergraduate, Jarrod admits he initially leaned towards the profession for its money-making potential. But this changed quickly when he realised the severe gap in financial literacy among many Singaporeans. “Most clients I’ve met don’t have a full understanding of their portfolio or even the changes in policies in Singapore,” he says. Now, he strives to be their go-to guy for all things finance-related, taking pride in being a trusted source of knowledge.

Sumit was motivated to join the profession to assist clients, challenge himself and develop his expertise. For him, the diverse role that financial advisors can take on – from wealth and risk management to estate planning – keeps things interesting and allows him to provide solutions to real-world problems.

Fighting the stigma

It’s possible that we may see a shift in the perception of this career. A recent survey by St. James’s Place showed that 80% of Singaporeans prioritise seeking financial advice before a major decision – especially after the pandemic. Ultimately, Tiffany, Jarrod, and Sumit agree that the best way to combat the stigma is to build strong connections and genuinely care for the well-being of their clients.

As Tiffany puts it, “I take time to understand the people I work with – their needs, desires, goals, and aspirations. It’s important to recognise that clients entrust their finances, families, and futures to us, so we need to have their backs,” she shares. For her, one of the most rewarding moments in her career was helping a senior client with her retirement plan. This brought them closer, and now they even enjoy bowling outings together.

Jarrod stresses the importance of being authentic and honest. He notes that if a stranger on the street asked about your finances, you likely wouldn’t divulge all the details immediately. It takes time to establish trust, and it’s important to understand clients’ objectives. He urges his fellow advisors not to let monetary incentives cloud their judgment – not every conversation has to lead to a sale.

Sumit believes that clients want to feel cared for, rather than viewed as a money tree. He builds real relationships with clients by establishing boundaries between personal and business conversations.

“If it’s for a good meal, I make it clear that there’ll be no talk of business. When it’s a business appointment, we’ll only talk about that and nothing else.” He tells me he has over a hundred clients and knows more about their lives and aspirations than their own family members. This strong bond allows him to suggest the appropriate policies to help them in tough situations, like saving a client from losing a $150,000 retirement fund.

What does it take to be a great financial advisor?

Think you have what it takes to succeed? If your sole motivation is money, this job isn’t for you.

“Building trust takes time, and it’s essential to understand why you want to work in this field,” Jarrod says. Financial advisors provide a human element that sets them apart from alternatives like robo-advisors. They can’t simply walk away from their responsibilities, and they must be there for their clients – even during life changes.

Sumit cautions those who are considering entering the field part-time or on an ad-hoc basis. He stresses that every dollar matters to the client. As financial advisors, you need to genuinely care for your client regardless of income earned. Empathy for the individual is the most important quality to have, even if clients don’t always follow your advice.

The decision to trust financial advisors isn’t an easy one. A wrong move can end badly for your bank account (yikes). But it’s important to recognise that while not all advisors are created equal, some are dedicated to your best interests.

These are the ones who can help you hit your personal goals, such as buying a home, planning for retirement, or even strengthening your finances to withstand a world-crushing pandemic. In essence: exercise caution, but don’t throw the baby out with the bathwater! It’s still best to get professional advice to build a secure future.